Retirement

Know Us Better

Where will your retirement money come from? If you’re like most people, qualified-retirement plans, Social Security, personal savings and investments are expected to play a role. Once you have estimated the amount of money you may need for retirement, a sound approach involves taking a close look at your potential retirement-income sources.

Articles

Healthcare Costs in Retirement

Retirement Read Time: 2 min

In a 2023 survey, 37% of all workers reported they were either “not too” or “not at all” confident that they would have enough money to pay for their medical expenses in retirement. Regardless of your confidence, however, being aware of potential healthcare costs during retirement may allow you to understand what you can pay for and what you can’t.1

Health-Care Breakdown

A retired household faces three types of healthcare expenses.

The premiums for Medicare Part B (which covers physician and outpatient services) and Part D (which covers drug-related expenses). Typically, Part B and Part D are taken out of a person’s Social Security check before it is mailed, so the premium cost is often overlooked by retirement-minded individuals.

Copayments related to Medicare-covered services that are not paid by Medicare Supplement Insurance plans (also known as “Medigap”) or other health insurance.

Costs associated with dental care, eyeglasses, and hearing aids – which are typically not covered by Medicare or other insurance programs.

It All Adds Up

According to one study, the average 65-year-old couple can expect to need $315,000 saved to cover healthcare expenses in retirement.2

Should you expect to pay this amount? Possibly. Seeing the results of one study may help you make some critical decisions when creating a strategy for retirement. Without a solid approach, healthcare expenses may add up quickly and alter your retirement spending.

Prepared for the Future?

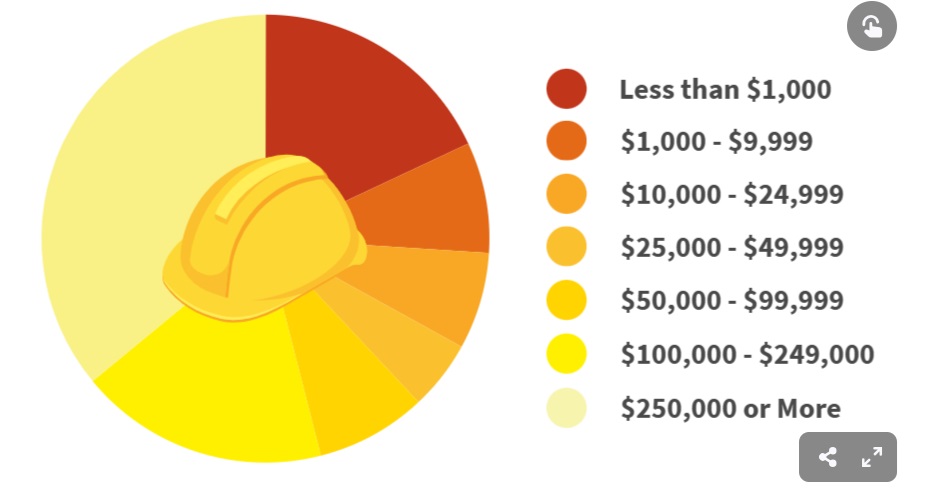

Workers were asked how much they have saved and invested for retirement – excluding their residence and defined benefit plans.

Source: EBRI.org, 2023

1. EBRI.org, 2023

2. Investopedia.com, October 23, 2023

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2024 FMG Suite.

Videos

Healthcare Costs in Retirement

Retirement Read Time: 2 min

In a 2023 survey, 37% of all workers reported they were either “not too” or “not at all” confident that they would have enough money to pay for their medical expenses in retirement. Regardless of your confidence, however, being aware of potential healthcare costs during retirement may allow you to understand what you can pay for and what you can’t.1

Health-Care Breakdown

A retired household faces three types of healthcare expenses.

The premiums for Medicare Part B (which covers physician and outpatient services) and Part D (which covers drug-related expenses). Typically, Part B and Part D are taken out of a person’s Social Security check before it is mailed, so the premium cost is often overlooked by retirement-minded individuals.

Copayments related to Medicare-covered services that are not paid by Medicare Supplement Insurance plans (also known as “Medigap”) or other health insurance.

Costs associated with dental care, eyeglasses, and hearing aids – which are typically not covered by Medicare or other insurance programs.

It All Adds Up

According to one study, the average 65-year-old couple can expect to need $315,000 saved to cover healthcare expenses in retirement.2

Should you expect to pay this amount? Possibly. Seeing the results of one study may help you make some critical decisions when creating a strategy for retirement. Without a solid approach, healthcare expenses may add up quickly and alter your retirement spending.

Prepared for the Future?

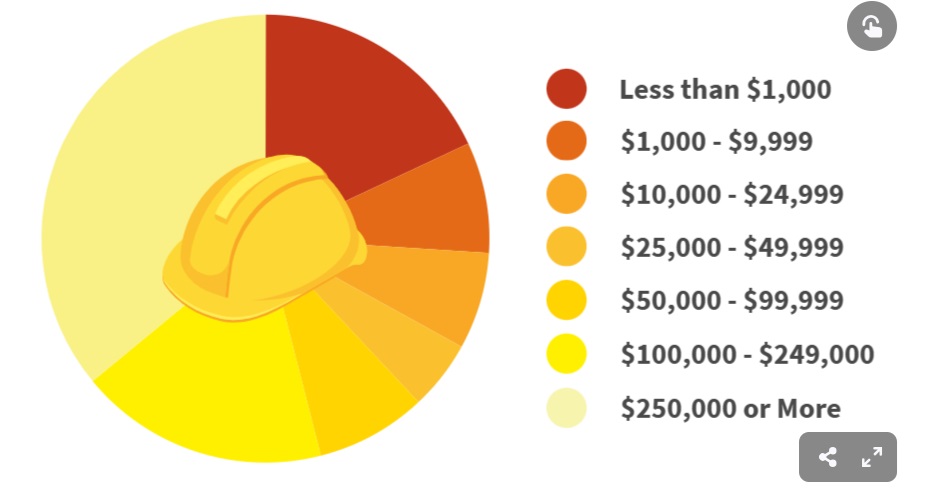

Workers were asked how much they have saved and invested for retirement – excluding their residence and defined benefit plans.

Source: EBRI.org, 2023

1. EBRI.org, 2023

2. Investopedia.com, October 23, 2023

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. It may not be used for the purpose of avoiding any federal tax penalties. Please consult legal or tax professionals for specific information regarding your individual situation. This material was developed and produced by FMG Suite to provide information on a topic that may be of interest. FMG Suite is not affiliated with the named broker-dealer, state- or SEC-registered investment advisory firm. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security. Copyright 2024 FMG Suite.

Have A Question About This Topic?

Have you ever needed Financial Guidance, but instead got a sales pitch for specific products or service without the Advisor even understanding your specific situation or what you wanted accomplished?

My passion for helping clients get better financial outcomes came from years of being a single parent balancing work and children. I experienced firsthand the lack of personalized financial guidance in running my household and consequently, made costly mistakes.

Quick Links

Check the background of your financial professional on FINRA's BrokerCheck .

The content is developed from sources believed to be providing accurate information. The information in this material is not intended as tax or legal advice. Please consult legal or tax professionals for specific information regarding your individual situation. The opinions expressed and material provided are for general information, and should not be considered a solicitation for the purchase or sale of any security.

We take protecting your data and privacy very seriously. As of January 1, 2020 the California Consumer Privacy Act (CCPA) suggests the following link as an extra measure to safeguard your data: Do not sell my personal information. https://go.jnorthfinancial.com/privacy

Copyright 2024 JNorth Financial

Form CRS Redwood ADV Part 3 https://reports.adviserinfo.sec.gov/crs/crs_312942.pdf

J North Financial, LLC and Joann North offer Investment advice through Redwood Private Wealth, 3930 E. Ray Road, Suite 155, Phoenix, AZ 85044 (“Redwood”). Redwood is an investment adviser registered with the Securities and Exchange Commission (“SEC”). Registration with the SEC should not be construed to imply that the SEC has approved or endorsed qualifications or the services Redwood offers, or that its personnel possess a particular level of skill, expertise or training. Important information and disclosures related to Redwood are available at https://redwoodprivatewealth.com. Additional information pertaining to Joann North and/or Redwood’s registration status, its business operations, services, fees and its current written disclosure statement is available on the SEC’s Investment Adviser public website at https://www.adviserinfo.sec.gov/. Redwood Private Wealth and JNorth Financial, LLC are independent of each other.

Click here for Full disclosures - https://go.jnorthfinancial.com/disclosure-1193